People generally tend to wonder about the ways in which PDF pages

Continue reading

The American Petroleum Institute (API) Q1 specification sets forth recommended practices for providing products and services to the petroleum and

Continue reading

The Kingdom of Saudi Arabia (KSA) represents an exciting opportunity for businesses seeking growth and diversification in a rapidly evolving

Continue reading

As a concerned parent, it can be overwhelming to see your baby in discomfort or struggling with certain movements. However,

Continue reading

Renewing a car driving license is an important process that ensures that licensed drivers continue to meet the necessary requirements

Continue reading

Dubai is a thriving business hub that attracts entrepreneurs and investors from around the world. When considering setting up a

Continue reading

When considering business setup in Dubai, one key factor is the cost of obtaining a mainland license. The cost of

Continue reading

Curtains are an essential part of a hotel’s interior design. They not only serve the practical purpose of blocking out

Continue reading

The Association of Chartered Certified Accountants (ACCA) is a leading global professional body for the accountancy profession. While the ACCA

Continue reading

Arbitration is a popular method of resolving disputes, but many misconceptions exist about the process and the laws surrounding it.

Continue reading

There are various factors that you should consider when choosing a chemical supplier. These include their knowledge, reputation, products, services,

Continue reading

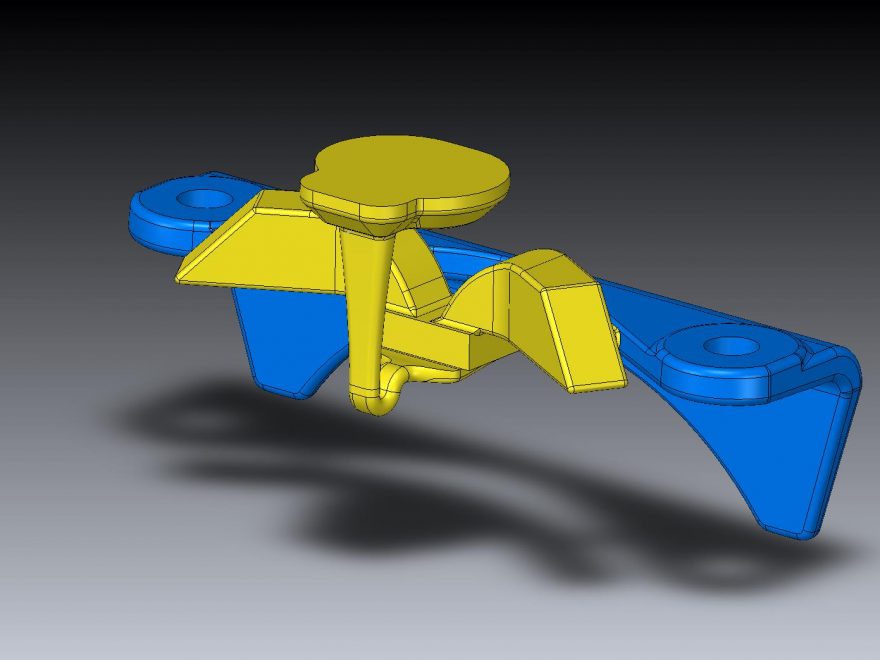

When it comes to what to look for when using 3d printing or model makers in Dubai, it can be

Continue reading

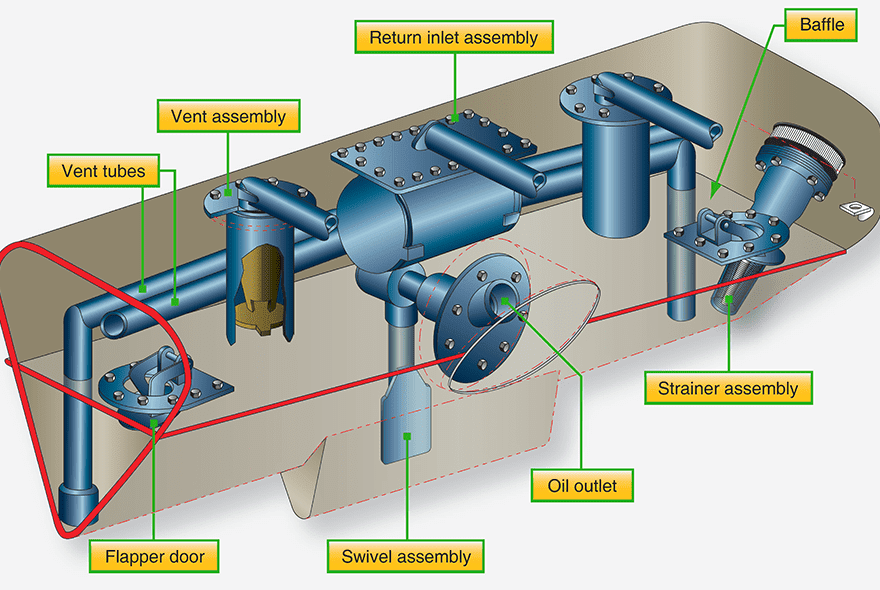

A lubricant is something that helps decrease friction between moving parts in mutual contact, and that therefore reduces the temperature

Continue reading

People generally tend to wonder about the ways in which PDF pages over a site are treated by search engines.

Continue reading

Life is surely one of the biggest blessings, and the ones who are able to live their life to the

Continue reading

You must have read, seen and heard about all those misconceptions. Chances are that at some point in time, some

Continue reading

Partying and meeting friends, this is one of the best things to do in your free days. Party means dressing

Continue reading

No matter how quality rich your sofa or other piece of furniture is, after the passage of time, it is

Continue reading

If truth be told, the cost of a personal trainer will play a major role in your decision if you

Continue reading

Free zones are actually geographically distinguished areas that have specifically been established for the purpose of attracting businesses and foreign

Continue reading

In this day and age, entertainment has become an integral part of our lives. We seek entertainment in every discipline

Continue reading